As of 2022, the real voluntary carbon market is valued at around $2 billion.

The compliance market is regulated by national, regional, or international carbon reduction regimes. These markets operate under a cap-and-trade system where only a certain amount of ‘allowances’ (basically a permit that ‘allows’ you to emit GHGs) are created. This then limits the amount of GHGs that a country or industry can emit.The cap represents a finite supply of allowances. You can’t create or remove allowance but they can be traded.

If an industry is able to achieve its mandated targets or, better yet, if they emit less than their allowance, it can sell the extra credits to someone else. The ability to trade surplus credits can financially motivate participants to reduce their overall emissions.

Examples of compliance carbon markets include the Kyoto Protocol, The European Union emissions trading system, the California emissions trading system, the Australia emissions trading system, the British Columbia emissions trading system, and the New Zealand emissions trading system.

The voluntary carbon market functions outside of the compliance market. Those that participate in this market don’t need to reduce their emissions, it’s entirely voluntary. Many companies participate because they feel it is the socially responsible thing to do, because of shareholder pressure, or because it’s a good PR move.

Instead of a cap-and-trade system, the VCM uses a project-based system in which there is no finite supply of allowances.

Within the VCM more carbon credits can be created through the development of environmental projects. Companies can buy these credits to offset unavoidable emissions and reach their targets.

Voluntary vs. Compliance Market

| Voluntary Market | Compliance Market | |

| Exchanged Commodity | Carbon offsets. Facilitated by the project-based system | Allowances. Facilitated by the cap-and-trade system. |

| How is the market regulated? | Functions outside of the compliance market. | National, regional or international carbon reduction regimes E.g. Kyoto Protocol, California Carbon Market |

| What is the price? | Voluntary credits tend to be cheaper because they cannot be used in compliance markets.2 Several factors impact the price such as project type, project size, location, co-benefits, and vintage. | Compliance credits tend to be more expensive because they are driven by regulatory obligations.3 |

| Who can purchase credits? | Businesses, governments, NGOs, and individuals | Companies and governments have adopted emission limits established by the United Nations Convention on Climate change |

| Where do credits trade? | Currently no centralized voluntary carbon credit market. Project developers can sell credits directly to buyers, through a broker or an exchange, or sell to a retailer who then resells to a buyer. | Companies that surpass their emission targets can sell their surplus credits to those looking to offset emissions. Credits can be sold under the Kyoto Protocols emissions trading scheme.4 |

This means that the removal or reduction of carbon or GHGs would not have occurred without the offset project.

For instance, a project developer looking to preserve a forest that is to be clear cut in Vietnam will have to prove that if the proposed project did not occur, the forest would be cut down.

Examples of the types of projects that are investable in the VCM include:

- Renewable energy

- Industrial gas capture

- Energy efficiency

- Forestry initiatives (avoiding deforestation)

- Clean water

- Regenerative agriculture

- Wind power

- Biogas

- Oil recycling

- Solar power

- Water filters

There are several key participants that are actively part of the VCM. These participants include:

- Project developers. Project developers work to produce the carbon credits that other sectors or industries will buy.

- Consumers. This group includes private companies, NGOs, governments, universities, and individuals that purchase carbon credits from producers.

- Retail traders. Traders purchase credits in bulk from suppliers, bundle the credits in portfolios, and then sell them to the end buyer, usually for a commission.

- Brokers. A broker will buy carbon credits from a trader and market them to a consumer. A broker will typically charge a commission. It is common for a broker to also act as a trader.

- Third-party verifiers. These are organizations, typically NGOs, that verify that a project meets its stated objectives and volume of emissions.

The pricing of carbon credits in the VCM is not as straightforward as it is in the compliance market. This is due to the many types of environmental projects that are available. Prices vary widely according to the category of the project (e.g. renewable energy vs. forestry) and even within a particular category. You can follow live carbon prices right here.Several other variables also contribute to how a carbon credit is priced, including:

- Size of project. Larger projects that produce higher volumes of carbon credits often have a lower price. Smaller projects are often more expensive to implement but produce fewer carbon credits.

- Location of offset. Where does the environmental project take place? Locations where there is conflict and higher risk may make the project more expensive.

- Vintage. What year did the emission reduction occur? Older projects are typically priced lower.

- Quality. The standard in which the project was certified can affect the price.

- Co-benefits. A co-benefit is any positive impact that is produced by the project above and beyond GHG emissions. For instance, if a project creates jobs for local communities or increases biodiversity, these are types of co-benefits.

According to a 2020 report by the World Bank, carbon prices on the VCM start at less than US$1/ton CO2e and increase to US$119/ton CO2e. And the price for almost half of emissions are at less than US$10/tCO2e.6

Rabobank, a Dutch multinational banking financial services company, reports that renewable energy projects have the lowest average prices at US$ 1.4/ton CO2e while projects in forestry and land use are on the higher end of the scale at US$ 4.3/ton CO2e.7

Pricing can also be affected by the co-benefits generated by the project. Projects that meet the UN’s SDGs can help to increase the value of the carbon credits.

Larger scale projects that don’t generate as many co-benefits or don’t meet the additional SDGs may trade at a discount.

To meet the temperature goals outlined in the Paris Agreement, the High-Level Commission on Carbon Prices stated that prices of at least US$40-80/tCO2 were necessary by 2020 and US$50 to $100/tCO2e by 2030.8 The OECD estimates a price of US$147 is needed by 2030 to reach net-zero emissions by 2050.9

In the compliance market, the current weighted carbon price is $34.99.10 This is higher than the VCM pricing but still below the High-Level Commission threshold.

The bottom line when looking at both the VCM and compliance markets is that the current carbon prices are too low to meet targets.

Where do these Credits Trade?

There is currently no centralized voluntary carbon market.11 Instead, project developers, or companies can sell their credits directly to buyers or through a broker. Project developers can also sell their credits to a retailer who can then resell the credits to a buyer. All voluntary credits must be verified by an independent third party and must adhere to existing standards.

Voluntary Demand Scenarios

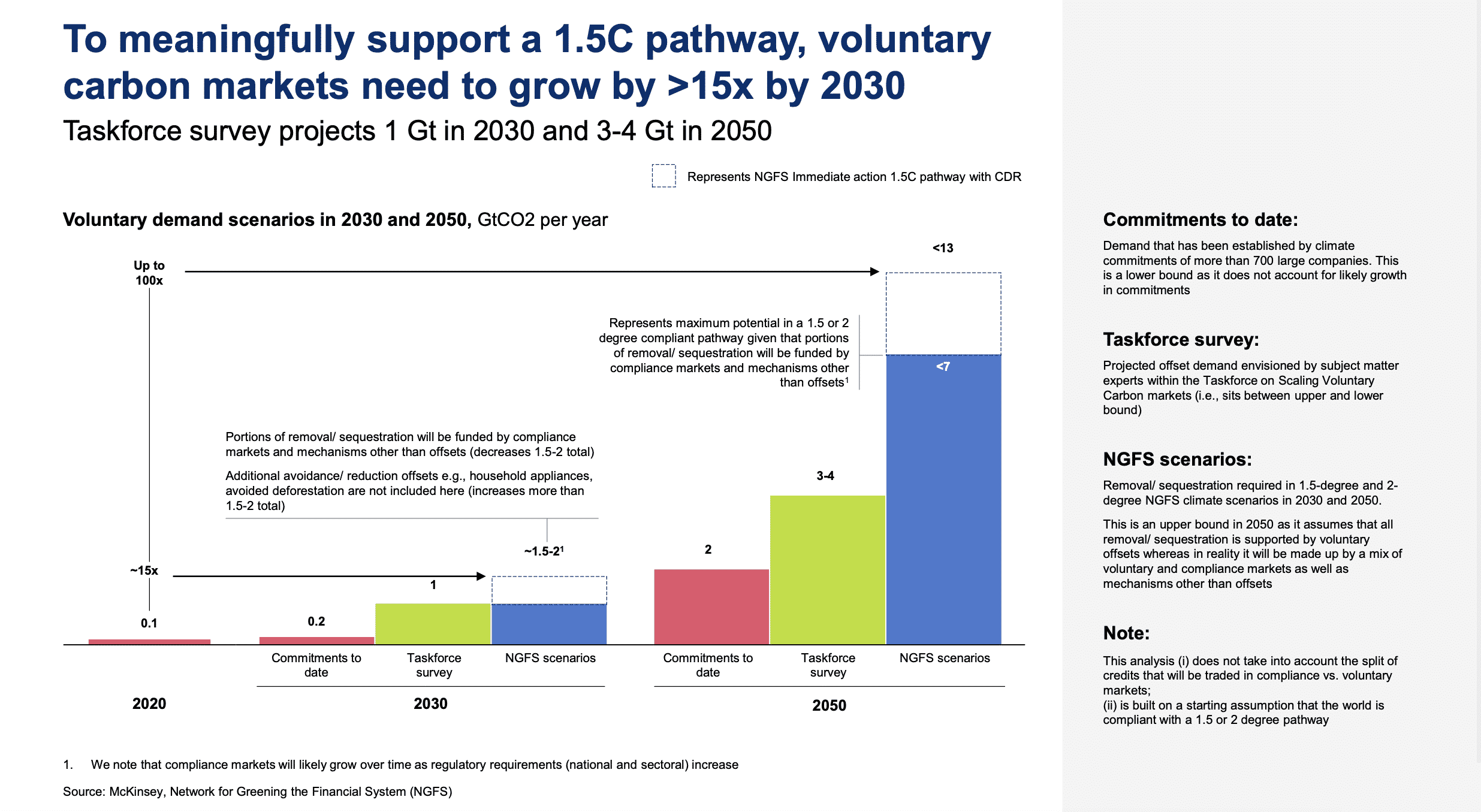

There is incredible demand projected for the voluntary market. According to the Taskforce on Scaling Voluntary Markets, the market will grow to around 15-fold from 0.1 to 1.5-2 GtCO2 of carbon credits per year in 2030.

And that will sacle up to a maximum of 100-fold by 2050 (7-13 GtCO2 of carbon credits per year).

Producing this incredible scale of carbon elimination will be a massive challenge. And it will provide many nations and corporations with incredible opportunities. As the taskforce mentions in their 2021 report,

“This underlines the need for emissions reduction to be implemented as urgently as possible, and likely at a faster pace than identified in the NGFS scenarios.”

Who verifies the Variable Carbon Market Credits?

When purchasing carbon offset credits, consumers should only consider offsets that are third-party verified.

There are a number of standards that use different methodologies for measuring and verifying carbon emission reduction. These standards provide a robust verification process to ensure the credibility of emission reduction projects. The most widely used standard include:

- Verra (The Verified Carbon Standard)

- Plan Vivo

- The Gold Standard

- The American Carbon Registry

- Climate Action Reserve

- The Verified Carbon Standard Program

Click Here to read more detail on who verifies carbon credits.

Can regular Mom-and-Pop Investors Invest in Voluntary Credits?

The VCM is open to anyone who wants to participate. From businesses to governments, non-profits, universities, and even individual investors.

If you are taking a long flight or vacationing on a luxury yacht and you want to absolve your environmental sins, you can buy carbon credits to offset your emissions. In fact, many airlines are making it easy for individuals to offset their flights. They list the amount of CO2 emitted by the flight and then give customers the opportunity to fly net-zero for a price which is offered at checkout.

The Bottom Line

Voluntary carbon credits are here to stay. More and more companies and individuals are feeling the need to do their part to reduce their carbon footprint. And, for companies that want to achieve carbon neutrality, the VCM is often a necessary tool.

References

¹://www.climateneutralgroup.com/en/news/what-exactly-is-1-tonne-of-co2/”>What Exactly is 1 Tonne of CO2? Accessed Aug 4, 2021

2 Carbon Offset Guide. Voluntary Offset Program. Accessed Aug 3, 2021

3 Carbon Offset Guide. Mandatory & Voluntary Offset Markets. Accessed Aug 3, 2021

4 UN Climate Change. Emissions Trading. Accessed Aug 3, 2021

5 S&P Global. Voluntary Carbon Markets. Accessed Aug 3, 2021

6 World Bank. State and Trends of Carbon Pricing 2020. Accessed Aug 4, 2021

7 Rabobank. Can voluntary carbon markets change the game for climate change? Accessed Aug 5, 2021

8 World Bank. Report of the High-Level Commission on Carbon Prices. Accessed Aug 5, 2021

9 UN Environment Programme. Discussion Paper on Governmental Carbon-Pricing. Accessed Aug 5, 2021

10 Carbon Credit Capital. Value of Carbon Market Update 2021. Accessed Aug 5, 2021

11 White & Case. Voluntary Carbon Markets:A Blueprint. Accessed Aug 5, 2021