The United Arab Emirates Carbon Alliance has made a significant pledge to purchase $450 million worth of carbon credits from the African Carbon Markets Initiative (ACMI) by the year 2030. This commitment underscores a substantial investment in carbon offsetting efforts and demonstrates a strong commitment to supporting sustainable development and climate action across the African continent. By actively engaging in carbon credit purchases from ACMI, the United Arab Emirates Carbon Alliance is contributing to the advancement of renewable energy projects, environmental conservation initiatives, and climate resilience efforts in Africa. This partnership highlights the potential for international collaboration to drive positive environmental impact and accelerate progress towards global climate goals.

The deal occurred at the first Africa Climate Summit where Sheikha Shamma bint Sultan, president and chief executive of the UAE Independent Climate Change Accelerators (UICCA) signed a letter of intent with ACMI.

It’s one of the highly-anticipated announcements at the 3-day event currently taking place in Kenya this week. Participating country leaders and delegates come together to ramp up climate action on the continent.

First African Carbon Credit Mega Deal

UICCA launched the UAE Carbon Alliance in June to help companies transition to a green economy. This is part of the country’s Net Zero by 2050 Strategic Initiative.

The Emirati coalition includes members such as Mubadala Investment Company, First Abu Dhabi Bank, Masdar, and AirCarbon Exchange.

Fueling Africa’s push for carbon credits is the ACMI, launched at COP27 last year. The initiative brings together African countries and large climate investors including Bezos Earth Fund and Rockefeller Foundation.

Their goal is to reduce emissions and bring transparency to voluntary carbon markets in the region through trading carbon offsets.

Run by McKinsey & Company, ACMI seeks to increase the stocks of African carbon credits to 300 million by 2030. Achieving this ambitious target needs great interest from large buyers and supporters of carbon markets.

African leaders particularly advocate for the use of market-driven financial mechanisms, such as carbon credits, also called offsets. These credits are created through projects that reduce emissions such as reforestation and shifting to renewable or cleaner energy sources.

Companies looking to compensate for their carbon emissions against their set targets can buy carbon credits. Each credit equals to preventing the release of one tonne of CO2.

The ACMI founders believe that to get enough carbon credits for their goal, they must secure early commitment from investors. And the UAE Carbon Alliance is their biggest backer so far.

The Emirati group aims to become “a leading hub for high integrity, high-quality carbon markets”, for trading carbon offsets. They seek to bridge the high-integrity supply of African carbon credits to high demand from the Middle East.

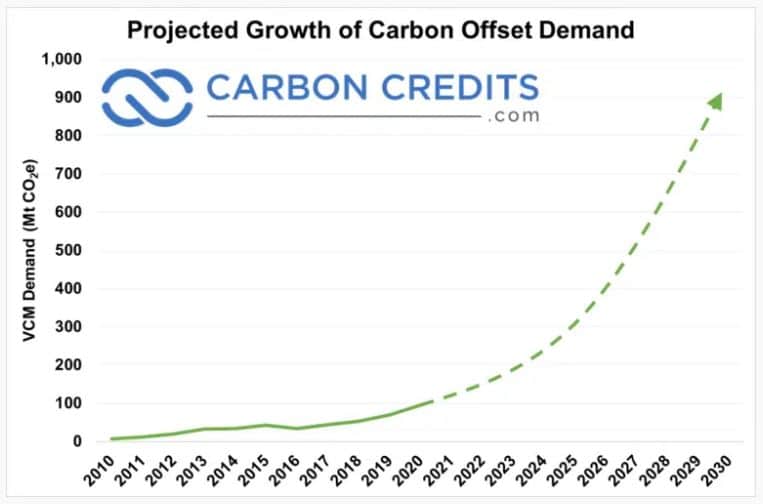

Globally, the demand for carbon credits is expected to grow exponentially despite criticisms thrown at the market. Industry estimates project that carbon offsets market size will surge to $250 billion by 2050.

Fostering Efficient Carbon Markets

Under UAE’s latest climate plan, the Gulf nation highlighted that while it focuses on meeting climate targets through domestic reduction efforts, it also “reserves the right” to tap into carbon offsets markets as specified in Article 6 of the Paris Agreement.

Reflecting the Middle East nation’s commitment, the Chairperson of the UAE Carbon Alliance, Khalifa Al Nahyan, said during the announcement:

“As we navigate the climate crisis, carbon markets stand as a pivotal tool in our decarbonisation journey… Through this pledge, we hope to foster more integrated and efficient carbon market mechanisms between our two regions.”

On their end, the ACMI CEO, Paul Muthaura commented that the UICCA’s $450M pledge shows the potential of international cooperation to tackle climate change.

He further noted that together, they “aim to create a sustainable, transparent, and equitable carbon market ecosystem in Africa”. This, in turn, can help drive a significant positive impact for the region and the world.

The Emirati government also announced plans to invest $54 billion by 2030 in renewables to meet the rising energy demand and achieve its 2050 net zero goal.

The UAE alliance is not the only buyer with a keen interest in African carbon credits.

Another company created by a royal family member of Dubai, Blue Carbon, also has inked agreements with African nations to manage a vast span of forests to produce carbon credits from their conservation and protection activities. The company will sell those offsets to countries looking to use carbon credits as a solution for their climate targets.

Turning Africa As Hub for Climate Investments, Not Disasters

African nations find carbon credits and similar market-driven financial mechanisms are crucial tools to attract funding from richer countries.

Currently, the ACMI’s Advance Market Signal manages to collect around $200 million for buying African carbon credits by 2030. Major signatories under the initiative are Vertree, Standard Chartered, ETG, and Nando’s, among others.

Nigeria alone can generate over 30 million tons of carbon credit each year by the end of the decade. That means the African nation can produce over $500 million a year through the sales of carbon offsets.

Organizers of the Africa Climate Summit aim to reposition the continent as a hub for climate-related funding and actions, instead of being known as a region plagued by climate disasters like droughts and floods.

In summary, the UAE Carbon Alliance’s monumental $450 million pledge to purchase carbon credits from the ACMI signifies a powerful stride in the global fight against climate change. This landmark commitment bridges nations and regions, fostering international cooperation to create a sustainable and efficient carbon market ecosystem.