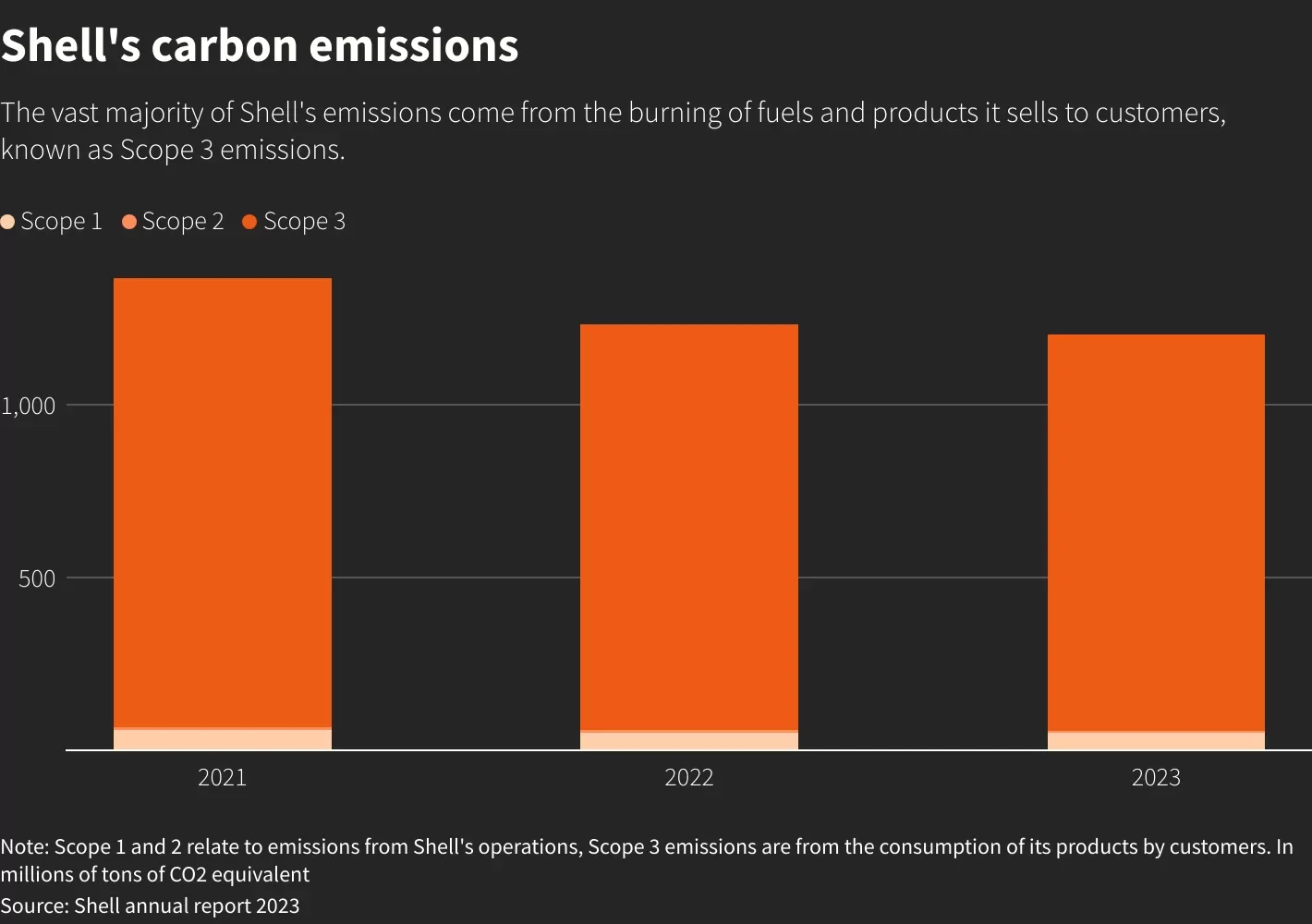

In 2023, Shell made a significant move by retiring 20 million tonnes of carbon offsets, a stark contrast to the 4.1 million tonnes included in its net carbon intensity for the previous year, 2022. This demonstrates a substantial increase in the company’s commitment to addressing its carbon footprint and mitigating environmental impact.

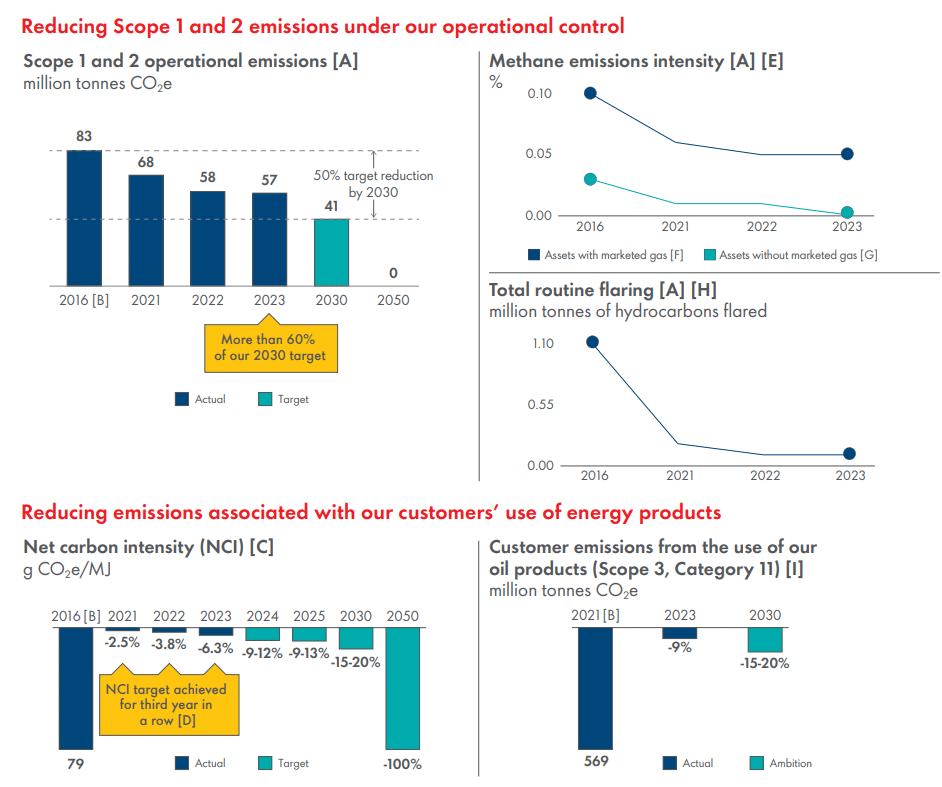

Despite this positive step, Shell faces the ongoing challenge of reducing emissions from its operations. The company has set a target to halve emissions from its operations by 2030, relative to 2016 levels. This ambitious goal underscores Shell’s recognition of the urgent need to transition to cleaner energy sources and mitigate the effects of climate change.

Shell’s commitment to reducing emissions aligns with broader industry efforts to combat climate change and transition towards a more sustainable energy future. As one of the world’s largest oil companies, Shell’s actions have the potential to influence the trajectory of global emissions and contribute to meaningful progress in addressing climate challenges.

Shell’s Energy Transition Strategy

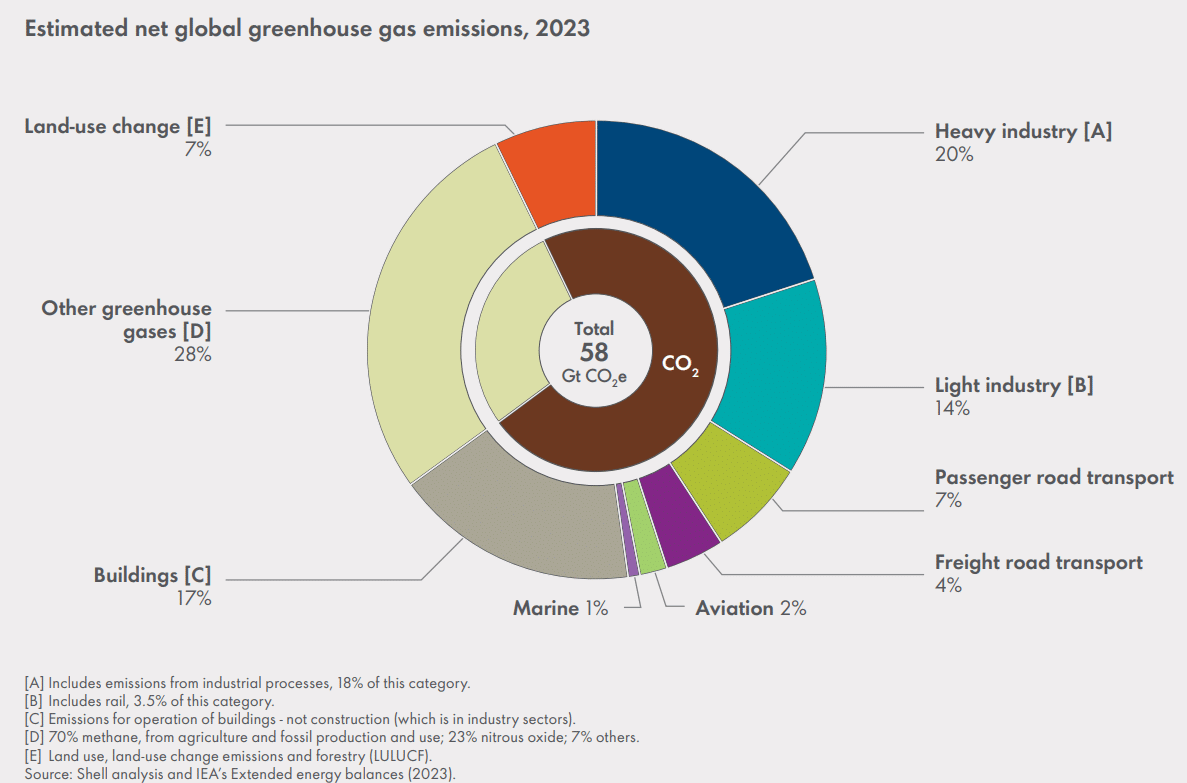

According to a report by Shell, carbon dioxide emissions from the energy system accounted for nearly three-quarters of global greenhouse gas emissions in 2023. This statistic underscores the significant contribution of the energy sector to the overall emissions footprint and highlights the urgent need for decarbonization efforts within this industry.

The dominance of carbon dioxide emissions from the energy system reflects the heavy reliance on fossil fuels for energy production and consumption worldwide. These emissions arise from various sources within the energy sector, including the combustion of coal, oil, and natural gas for electricity generation, transportation, heating, and industrial processes.

Addressing carbon dioxide emissions from the energy system is crucial in combating climate change and achieving international climate targets. Transitioning to cleaner and more sustainable energy sources, such as renewable energy and low-carbon technologies, is essential to reduce emissions and mitigate the adverse impacts of climate change on a global scale.

Shell’s report underscores the pressing need for concerted efforts to accelerate the transition to a low-carbon energy system, both within the energy industry and across sectors. By prioritizing investments in renewable energy, energy efficiency, and emissions reduction technologies, stakeholders can work towards reducing carbon dioxide emissions from the energy system and advancing towards a more sustainable and resilient future.

The implementation of stricter government policies could facilitate a reduction in carbon emissions at a pace aligning with the temperature objectives outlined in the Paris Agreement. Even without such policies, estimates say that global demand for fossil fuels would decrease from the current level of about 80% to below 70% by 2040.

Should the world adopt a trajectory towards achieving net zero emissions by 2050, this figure could drop to 50%. This shift will be primarily driven by the increased adoption of electrification and the expansion of renewable energy generation.

In its recently released first Energy Transition Strategy 2024 update, Shell revealed a new ambition to decrease customer emissions resulting from the use of its oil products by 15-20% by 2030 compared to 2021 levels.

The report also underscores the company’s commitment to achieving net zero emissions across all operations and energy products by 2050 as seen below.

Shell Net Zero Target

Wael Sawan, Shell’s Chief Executive Officer, highlighted the pivotal role of energy in development and emphasized Shell’s dedication to providing both present energy needs and building a low-carbon energy system for the future. The strategy focuses on performance, discipline, and simplification to maximize impact throughout the energy transition while creating value for investors and customers. Sawan further noted that:

“By providing the different kinds of energy the world needs, we believe we are the investment case and the partner of choice through the energy transition.”

Progress in Action

The update outlines Shell’s progress in various areas:

- Reduction in Emissions: By the end of 2023, Shell had achieved over 60% of its target to halve emissions from its operations, also known as Scope 1 and 2 emissions, by 2030 compared to 2016 levels. Notably, the company exceeded targets set by signatories to the Oil and Gas Decarbonization Charter agreed at COP28.

- Methane Emissions Reduction: Shell achieved 0.05% methane emissions intensity in 2023, significantly below its target of 0.2%.

- Carbon Intensity Reduction: Shell achieved a 6.3% reduction in the net carbon intensity of energy products sold in 2023 compared to 2016. This is the third consecutive year of hitting this target.

The oil major aims to focus on markets and segments where it can add the most value. These include the expansion of renewable power in key regions such as Australia, Europe, India, and the USA.

Consequently, there will be a lower total growth of power sales by 2030, leading to an update in the net carbon intensity target, now targeting a 15-20% reduction.

To support its transition to a net zero emissions energy business, Shell plans to invest $10-15 billion between 2023 and the end of 2025 in low-carbon energy solutions.

Last year, Shell invested over $5 billion on these solutions, which is over 23% of its total capital spending. These investments include electric vehicle charging infrastructure, biofuels, renewable power, hydrogen, and carbon capture and storage technologies.

Shell aims to scale up these technologies to make them more affordable for customers. The energy company also advocates for policies supporting national net zero goals, including carbon pricing.

Shell’s Strategic Shifts and Sustainable Practices

In 2023, Shell’s net carbon intensity accounted for 20 million carbon credits, of which 4 million were linked to energy products. Of the 20 million retired carbon credits, 85% were certified by Verra, 9% by the American Carbon registry, 6% by Gold Standard, and less than 1% via Australian Carbon Credit Units.

Europe’s largest oil major discreetly abandoned its plan to allocate $100 million annually to carbon credits last year. Shell’s plan, by far, is the largest carbon offset program among corporations, announced 6 months after Wael Sawan became the CEO.

Sawan unveiled a significant strategy shift for Shell, indicating the company’s intention to sustain its current level of oil production until 2030. The revised strategy prioritizes cost reduction and enhancing shareholder profits.

Oil majors have faced growing investor pressure to prioritize their most profitable ventures, particularly following periods of robust profits alongside declining returns from renewable energy ventures.

As the world’s largest liquefied natural gas (LNG) trader, Shell emphasized its belief in gas and LNG’s pivotal role within the energy transition. It remarked that these energy resources are vital alternatives to harmful carbon sources in power plants.

The oil giant earned a net profit of $28 billion in 2023 amid strong LNG and oil sales.

In conclusion, Shell’s energy transition update reflects its commitment to reducing emissions, investing in low-carbon solutions, and driving sustainable energy practices to achieve its net zero emissions target by 2050.