Japan is ramping up its carbon credit trading efforts, even as greenhouse gas offsets receive heightened scrutiny following reports that a significant number do not live up to their claims.

Over the past year, the Tokyo Stock Exchange, startups and others have each launched marketplaces for carbon credits.

The credits, which are certified by governments or independent bodies, are tradable instruments that represent a reduction of a certain amount of emissions, allowing polluters to offset their own emissions by buying them.

For Japan, carbon credits are seen as important as the nation waits for its climate tech bets to pay off, while carbon-intensive industries — of which Japan has a number — see them as vital as they undergo arduous green transitions.

“Japan could be left behind by this major global trend of carbon credit trading,” said Kohei Nishiwada, chief of Tokyo-based startup Asuene, which jointly started its carbon credit trading platform Carbon EX with SBI Holdings, an online financial conglomerate, last October.

Europe was an early mover on carbon trading, starting the EU Emissions Trading System in 2005, while voluntary carbon credit market platforms have been launched in the U.S. in recent years.

With decarbonization efforts growing worldwide, more marketplaces have emerged in Asia over the past several years as well. Singapore is seen as a leading Asian hub for carbon credit trading, while Indonesia is eager to achieve a similar standing.

Nishiwada said that Japan needs to accelerate its efforts on carbon credit trading platforms, adding that Asuene, which on June 14 announced ¥4.2 billion ($26.3 million) in investment from 17 companies including Sumitomo Mitsui Banking, is keen to become an international marketplace.

If Asuene can become a major international platform, it would benefit Japanese firms running businesses globally, Nishiwada said, because they could buy various credits that could be used to meet reduction targets in other countries. Due to the current lack of such a marketplace in Japan, some domestic companies have to contact local consultants in other countries to purchase carbon credits for high prices, he added.

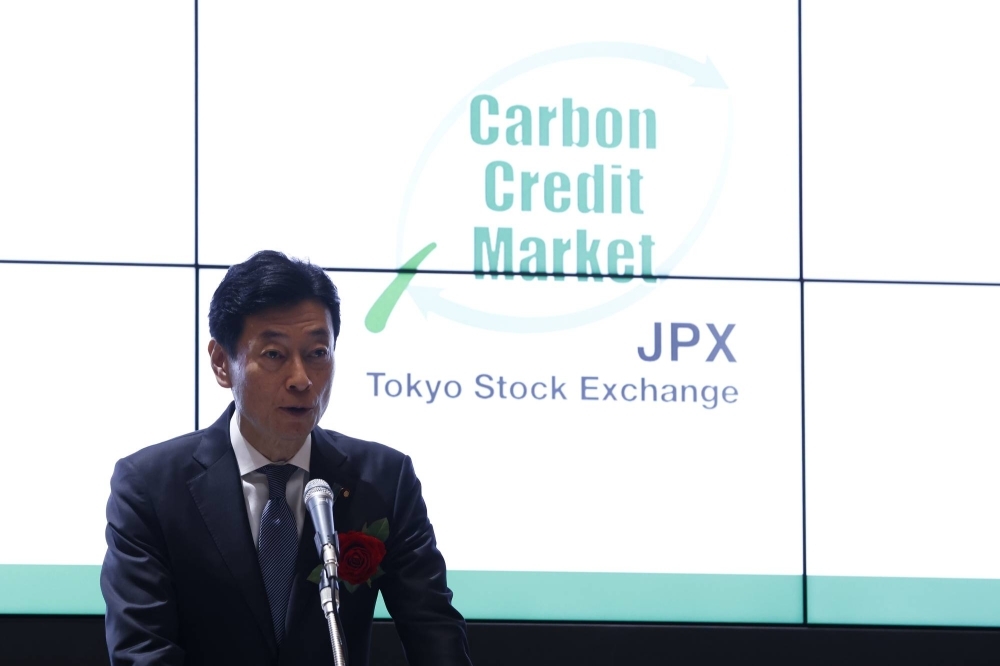

At the same time that Asuene rolled out its marketplace last October, the TSE opened its carbon credit trading market where companies can buy and sell “J-Credits,” which are certified by the Japanese government.

As of the end of May, the TSE market had seen a total trading volume of credits worth about 333,000 tons of carbon. In comparison, the Singapore marketplace Climate Impact X recorded about 1 million tons less than four months after its launch last year.

“Trading at the TSE market has been far from booming,” said Hiroki Yoda, a researcher at Daiwa Institute of Research. “One of the major reasons is that the trading is very limited at the TSE market, since it only deals with J-Credits.”

Asuene’s Carbon EX provides a range of carbon credits, including some voluntary international credits, while the total number of firms participating in its market exceeds 1,000 — compared with 282 for the TSE market.

Voluntary carbon credits are issued by mainly nongovernmental organizations and other private bodies that certify projects expected to reduce greenhouse gas emissions. Major voluntary carbon credits include those certified by Verified Carbon Standard, Gold Standard and the American Carbon Registry.

Anticipating that carbon credit trading will spread further in the coming year, some companies spy an opportunity, and Tokyo-based startup Green Carbon is one of them.

Green Carbon supports farmers in creating carbon credits so that they can sell them to earn extra income while contributing to decarbonization.

“We want to help curb global warming through the power of nature rather than the power of machines,” said Jun Okita, the head of Green Carbon, who had previously worked as a consultant focusing on what are known as “environmental, social and governance” considerations.

Rice farmers can reduce methane emissions by taking extra time to practice what is called midseason drainage, which sees the removal of flood water from rice crops to dry the soil. By prolonging the period of the midseason drainage by a week or so, the soil is exposed to oxygen for longer, which reduces emissions of methane — a particularly potent greenhouse gas. About 40% of all methane emissions in Japan comes from rice paddies.

“Midseason drainage has been a common practice for rice farmers and it just takes an extra week to create carbon credits without any initial costs,” Okita said, referring to the application fees for J-Credits. Applying for J-Credits typically costs ¥1 million to ¥2 million, but Green Carbon has established a consortium that shoulders such costs for farmers.

According to Green Carbon, a rice farmer with a 50-hectare paddy could earn about ¥1 million annually if they successfully sell credits.

Many farmers in Japan are still not aware of carbon trading, so they don’t know they can make credits through their practices. But to create credits it is essential to prepare farming data, which many small-scale farmers don’t maintain, Okita said.

The consortium will also play the role of a sales agency for farmers by approaching companies that want to buy credits. In addition, farmers who have earned J-Credits can promote their rice to consumers as environmentally friendly.

“I’m quite certain that carbon credit trading will boom. We have been talking to many listed firms and most of them are interested in carbon credits,” Okita said. “They are observing the situation and how other companies are doing to see when the wave will really come.”

In the meantime, the government has launched an initiative called the GX League — in Japan, “GX” refers to “green transformation” — in which participating companies set voluntary emission reduction goals. To meet them, the use of J-Credits is allowed.

According to the industry ministry, the number of firms that joined the GX League totaled 747 as of April, with these including major manufacturers, airlines and utilities.

Through this initiative, Japan is looking to stimulate carbon credit trading. But “under the current phase, it’s up to companies whether they want to participate in the GX League and then set emission reduction goals. Even if they don’t meet the goals, they are not required to buy carbon credits if they explain why they have failed. Thus, it’s unlikely that demand for carbon credits will sharply increase at this point,” Yoda of the Daiwa Institute of Research said.

The government is planning to update the GX League initiative around 2026 to attract more firms and will possibly make it mandatory for emission-heavy companies to participate in carbon trading.

But amid Japan’s attempts to foster carbon credit markets, offsets have come under scrutiny, with some saying these trading systems simply allow companies to keep polluting.

One issue is whether the credits really reduce emissions as advertised. In January last year, The Guardian reported that it had found that over 90% of rainforest carbon offsets certified by Verra — one of the major global certifiers of carbon credits — did not reduce carbon emissions as claimed.

Meanwhile, there is concern about how long carbon will be locked away — if the carbon accounted for by offsets is not kept out of the atmosphere permanently, this can lead to overestimates of their effectiveness. This is a particular concern for forest-based offsets, which are threatened by pests, disease and climate change itself.

Some carbon offset projects involving forest protection have also attracted controversy for violating the human rights of Indigenous people and local communities.

In light of the criticisms, some overseas firms have been hesitant to offset their carbon footprint by purchasing credits. Switzerland-based Nestle had said it would rely on carbon credits to achieve its 2050 net zero target but has since changed its strategy, saying it no longer plans to purchase credits.

In an effort to improve the integrity of carbon credit markets, the U.S. government introduced new guidelines last month.

Market watchers still project that the carbon credit trading will expand in the coming years. Morgan Stanley expects the voluntary carbon offsets market will grow to be worth about $100 billion in 2030, compared with $2 billion in 2022.

Hiroyoshi Niwa, an executive at Deloitte Tohmatsu Consulting who is well-versed in carbon credit trading, said the system of carbon credit trading itself is effective for decarbonization in the longer term, since emission-heavy industries need to somehow offset their emissions until technological innovation happens.

The aviation industry, for instance, needs to find ways to produce at scale so-called Sustainable Aviation Fuel — biofuel with a lower carbon footprint than conventional jet fuel — while other companies are relying on the decarbonization of the electricity grid.

However, “there have been discussions on the pros and cons of voluntary carbon credits overseas, as methodology to prove credibility is not fully established yet,” Niwa said. Yet private certification bodies have been tightening rules and improving transparency of carbon credit projects, so “I believe that shady credits will naturally be eliminated from marketplaces,” he added.

As Japan is looking to grow marketplaces and get more firms to engage in carbon credit trading, “it is really important that companies purchase decent credits to offset their emissions,” Niwa said. “Market platforms need to make efforts to ensure the credibility of carbon credits.”