The European Union’s carbon market has recently encountered a notable downturn, marked by carbon prices plummeting to a 28-month low. This decline can be attributed to a combination of factors, including macroeconomic uncertainties and reduced volatility in global gas and power markets.

Amidst this challenging market environment, the EU has unveiled an ambitious new climate target, setting its sights on slashing greenhouse gas (GHG) emissions by 90% by the year 2040. While this announcement initially sparked optimism, analysts caution against premature enthusiasm, foreseeing continued bearish trends as economic headwinds persist.

The convergence of these factors underscores the complex dynamics at play within the EU’s carbon market and highlights the ongoing efforts to balance environmental objectives with economic realities. As stakeholders navigate these challenges, attention remains focused on how policies and market mechanisms will evolve to support the EU’s ambitious climate agenda amidst a shifting economic landscape.

Carbon Crunch: EU’s Carbon Market Saga

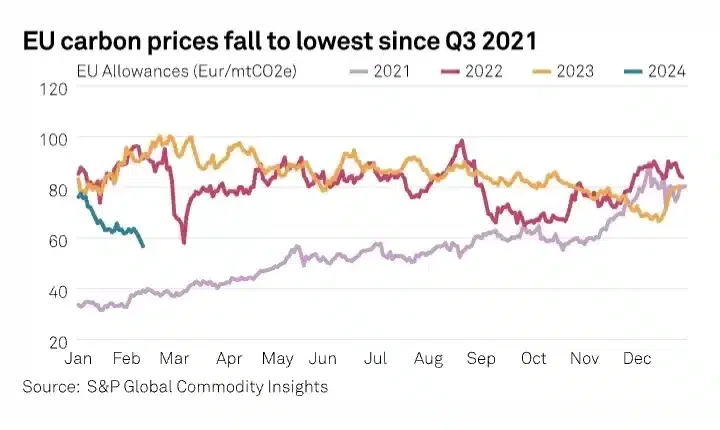

The EU carbon prices recently hit a 28-month low, trading at Euros 56.5 per mtCO2e ($60.5/mtCO2e) on Feb. 14, according to data from the Intercontinental Exchange. Comparatively, EU Allowances (EUAs) were at a record high of over Euros 100/mtCO2e around the same time last year.

However, since the 4th quarter of 2023, prices have been on a notable downward trajectory. Analysts attributed that trend to macroeconomic uncertainties, political challenges, and decreased volatility in the global gas and power markets.

The recent weakness in the European carbon market was evident in the EU daily carbon auction, where both prices and demand experienced sharp declines. As shown below, the cleared price for the EUA auction at 56.24 Euros or US$58.45/mtCO2e was the lowest price since Q3 2021.

Traders and analysts anticipate the bearish trend in the EU carbon complex to persist as the region anticipates further economic headwinds in the coming months.

Traders and analysts anticipate the bearish trend in the EU carbon complex to persist as the region anticipates further economic headwinds in the coming months.

Moreover, a veteran hedge fund investor sees a further slump in European Union carbon permits on the horizon as energy supplies soar and demand remains subdued. Per Lekander, CEO of London-based Clean Energy Transition, said that a flood of renewable power, alongside falling gas prices and a recovery in nuclear and hydro plants will keep the pressure on carbon prices.

Prices have already slumped 30% this year as that combination curbs pollution that’s the basis for demand to buy emissions permits in Europe.

Analysis by S&P Global expects average prices for 2024 to plummet to Eur 63.90/mtCO2e, compared to Eur 85.30/mtCO2e in 2023 and Eur 81.50/mtCO2e in 2022.

Thus, many have revised down their EUA 2024 price forecasts. They attribute the decline to recession concerns and reduced emissions from power and industrial sectors.

EU’s Bold Climate Agenda for 2040

The European Commission unveiled a bold new climate target, setting its sights on slashing the bloc’s GHG emissions by 90% by 2040, relative to 1990 levels.

This ambitious target closely aligns with the recommendations put forth by the European Scientific Advisory Board on Climate Change. The organization advises a reduction of emissions by 90% to 95%.

More notably, this intermediary step serves as a crucial bridge between the EU’s current objectives:

- Cutting net emissions by 55% by 2030 and achieving net zero emissions by 2050.

The analysis conducted in the impact assessment of the new proposal indicates that the remaining EU GHG emissions in 2040 should not exceed 850 million metric tons of CO2-equivalent (MtCO2-eq). Meanwhile, carbon removals, facilitated through land-based and industrial carbon removal methods, should aim to reach up to 400 MtCO2.

Achieving this new climate agenda requires a couple of initiatives, including:

- a significant shift towards renewable energy systems,

- phasing out coal-fueled power generation and reducing overall fossil fuel usage by 80%,

- and a substantial reduction in gas dependency within the EU’s energy infrastructure.

It also calls for major transformations in various sectors such as transportation, agriculture, construction, manufacturing, and waste management.

This ambitious target is essential to ensure the EU remains aligned with the objectives outlined in the 2015 Paris Agreement. The agreement aims to limit the planet’s long-term average temperature increase to well below 2°C and preferably below 1.5°C.

From Downturn to Turnaround

Moreover, the proposal underscores the economic imperative of addressing climate change, highlighting the potential costs of inaction. Failure to limit global warming to 1.5 degrees Celsius above pre-industrial levels could result in additional costs of 2.4 trillion euros in the EU by 2050, primarily due to the heightened risk of more severe and destructive extreme weather events.

In 2022, the EU made significant strides in reducing GHG emissions, achieving a 33% reduction compared to 1990 levels.

EU CO2 Emissions, 1965-2022

Additionally, a separate EU document outlines plans to capture and store hundreds of millions of tons of CO2 emissions by 2050, emphasizing the substantial investment required in new technologies to address climate challenges effectively.

However, it’s important to note that the 2040 ambition is currently a non-binding recommendation from the European Commission, intended to initiate political discussions. A formal proposal will only be presented after the elections to the European Parliament.

It remains uncertain how the final decision would impact the European carbon market and prices. Regardless, the EC’s ambitious 2040 climate target underscores the EU’s commitment to addressing climate change and ensuring a sustainable future.

However, it remains imperative for policymakers to translate these goals into concrete actions to mitigate the potential costs of inaction.