Insurance plays a crucial role in supporting carbon markets as the global community strives towards achieving net-zero emissions. As companies and governments implement carbon pricing mechanisms and engage in emissions trading, insurance provides a vital layer of financial protection against potential risks and uncertainties associated with these activities.

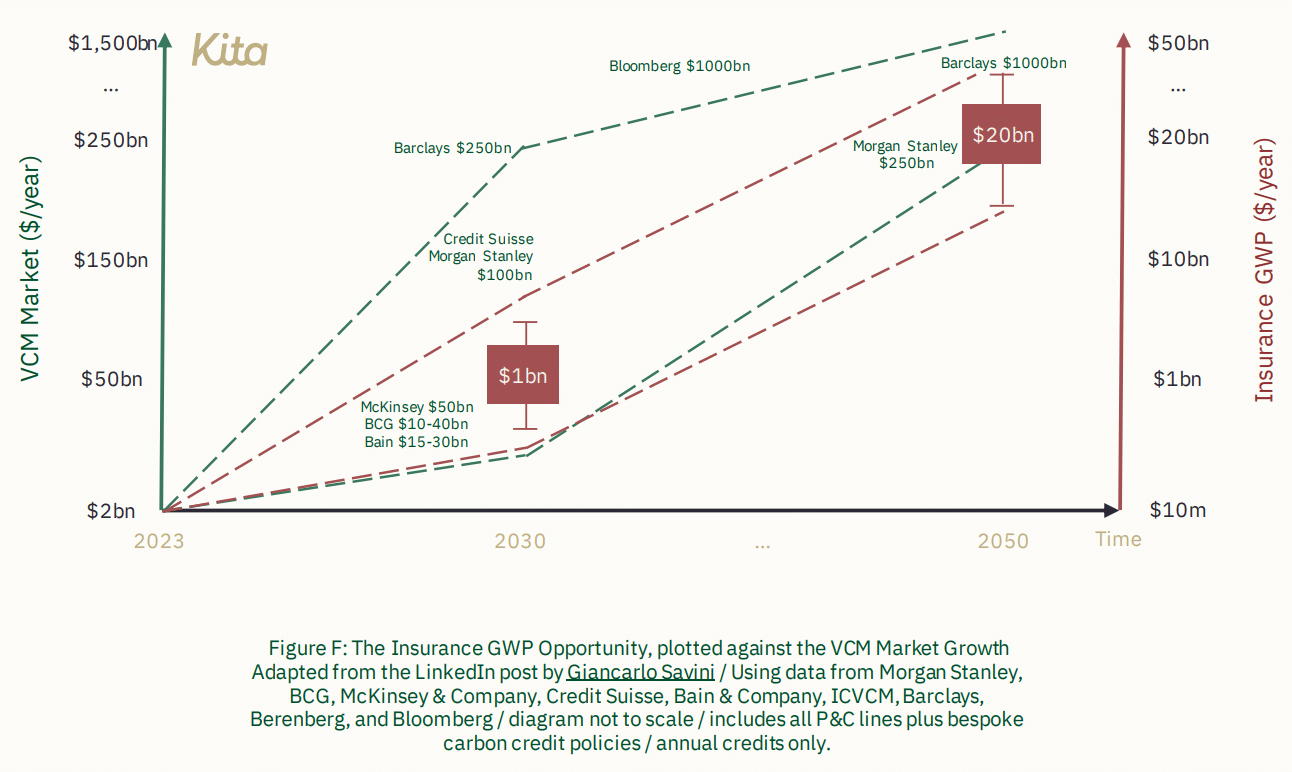

A recent report highlights the significant growth potential of the carbon credit insurance market. By 2030, it is estimated that insurance premiums related to carbon markets could reach approximately $1 billion, reflecting the increasing recognition of the importance of mitigating climate-related risks. Looking further ahead, projections suggest that by 2050, these premiums could expand substantially to range between $10 billion and $30 billion.

This growth trajectory underscores the increasing significance of insurance in facilitating the transition to a low-carbon economy. Insurance products tailored to carbon markets provide coverage for various risks, including regulatory changes, project failures, and uncertainties related to carbon pricing. By mitigating these risks, insurance not only incentivizes greater participation in carbon markets but also fosters confidence and stability in the transition towards a sustainable future.

Furthermore, as the global community intensifies its efforts to combat climate change, the role of insurance in supporting carbon markets is expected to become even more pronounced. Insurance companies are likely to develop innovative products and risk management solutions to address the evolving needs of businesses and governments involved in carbon trading and emission reduction initiatives.

The report is a collaboration between Oxbow Partners and Kita, titled “Are carbon credits the next billion-dollar insurance market?”

Premiums with a Purpose: The Role of Carbon Credit Insurance

The study emphasizes the crucial role of insurance in supporting the carbon market amid global efforts to combat climate change. It also provides a comprehensive overview of the carbon market’s potential, offering valuable insights for industry experts.

According to the report, insurance can provide 4 key benefits to the carbon credit market:

- A balance between traditional risk management practices and innovation – enabling improved access to finance to scale carbon projects.

- A stamp of confidence – risk management and regulatory expertise, honed over decades, can bring confidence to the market and its participants.

- Detailed assessment of carbon project risk – highlighting areas of concern across the market and project types, where wider risk management improvements are required.

- Encourage market participants to take risks – insurers take on responsibility when things go wrong, giving market actors the freedom to take risks which are necessary to release capital and scale carbon projects and their associated benefits.

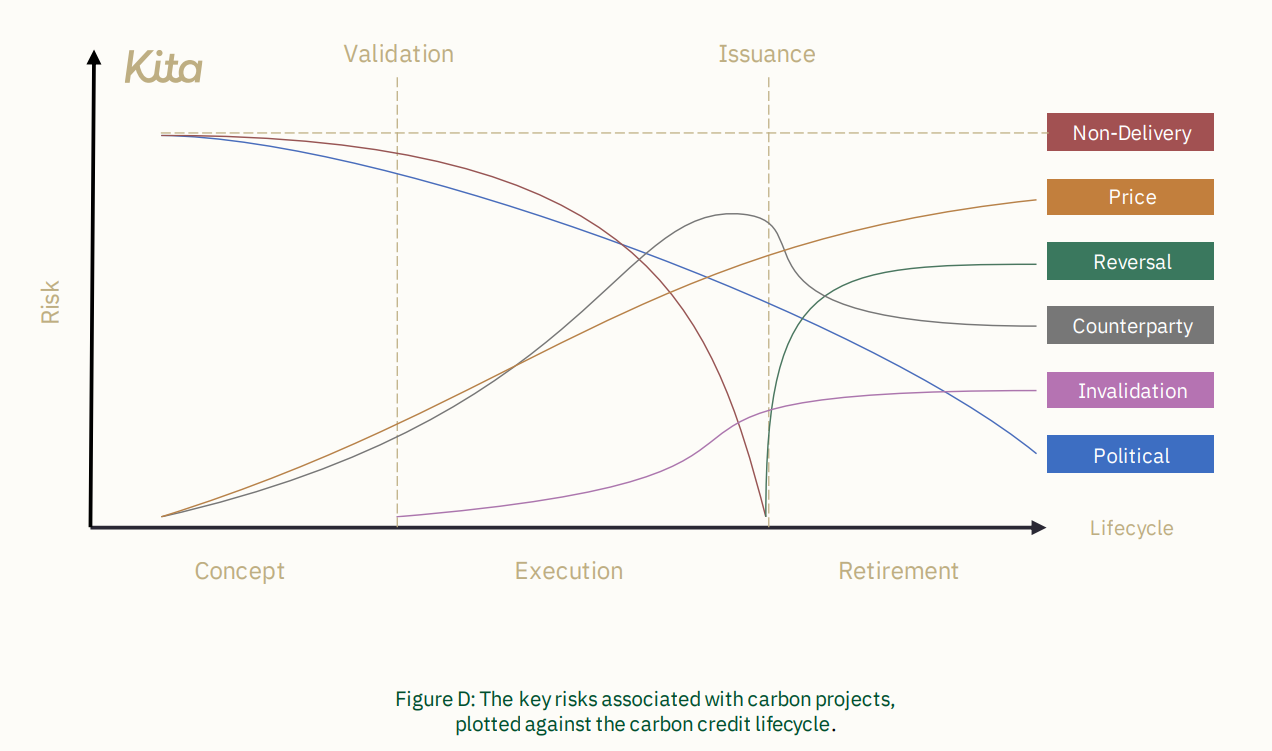

Below are the risks identified in the report, which the insurance market could mitigate.

Miqdaad Versi, Head of the Sustainability Practice at Oxbow Partners, expressed optimism about the market’s potential. He particularly highlighted its importance in facilitating green initiatives while generating profits. While James Kench, Head of Insurance at Kita, added that:

“The insurance market is on the front line for climate risk and is uniquely placed to help business and society navigate through increasingly uncertain times. This report is a call to action for the insurance industry to embrace a vast new carbon risk pool with purpose.”

The Billion-Dollar Horizon

The report forecasts the total addressable market for carbon credit insurance to reach about $1 billion in annual Gross Written Premium (GWP) by 2030, with a projected increase to $10-30 billion GWP by 2050.

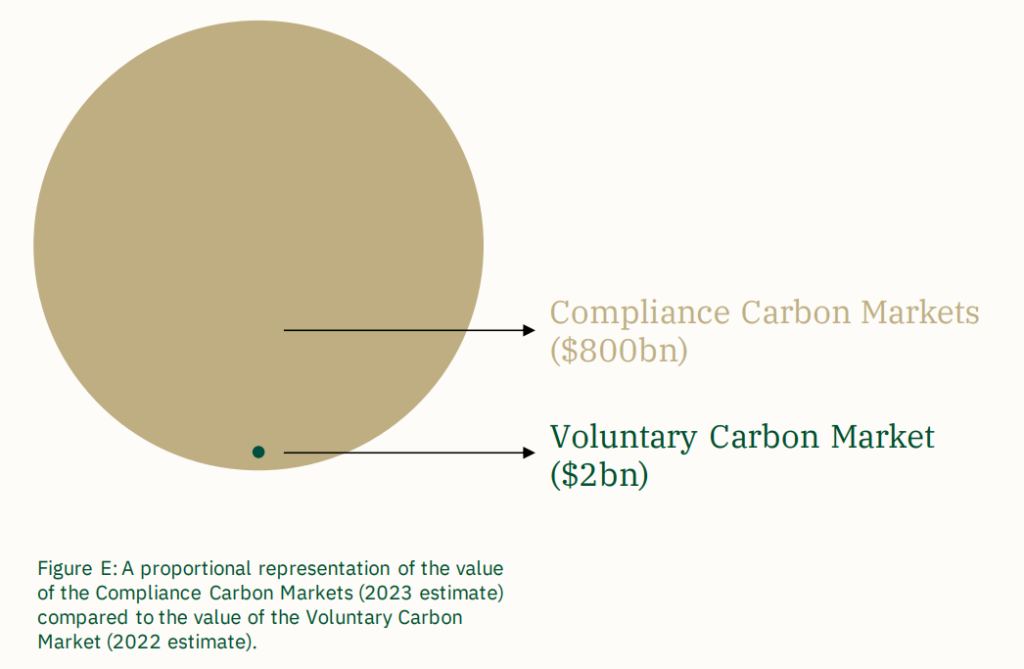

In 2023, the global Compliance Carbon Markets were valued at over $800 billion. These markets are closely linked to policy shifts and geopolitical tensions, leading to fluctuations in their size and growth trajectory depending on external factors and the prevailing environment.

In 2022, the VCM was valued at $2 billion. However, Abatable, a carbon intelligence and procurement platform, estimated that in the same year, deals worth $10 billion were executed. This implies that investment into the market was about 5x the value of the carbon credits issued.

According to a Barclays Special Report, the VCM could grow to $250 billion by 2030. Various organizations have made predictions of VCM growth in 2030, with estimates ranging from $10 billion to $250 billion. The complexity, rapid evolution, and convergence of the markets make size predictions challenging.

However, even the lowest forecasts anticipate the market to grow 5x. Long-term predictions are optimistic, with some expecting the market to exceed a trillion dollars by 2050.

Currently, the VCM predominantly covers credits sold by carbon dioxide removal (CDR) projects.

McKinsey estimates that based on expected delivery of announced projects, the CDR market could reach $40-$80 billion by 2030. As the CDR industry scales up, which overlaps with the VCM, it’s likely to further stimulate market growth.

So, if the VCM and compliance carbon markets converge as expected, it would lead to a substantial market expansion.

Addressing Risks in the Carbon Market

The GWP opportunity covers a broad spectrum of insurance needs within the carbon market sector. This includes specialized insurance for carbon credits as well as traditional insurance lines necessary for carbon projects and businesses operating in this sector. For instance, construction, property, casualty, financial lines, and marine insurance, among others.

While the report’s long-term prospects for the insurance industry are optimistic, their approach in estimating the potential market opportunity was conservative.

The authors also discounted the potential impact of regulatory mandates requiring insurance and the merging of both markets. Their estimation was also based on the projected annual carbon credit market, rather than the additional investment required to produce these credits themselves. Factoring in the latter could potentially result in a multiple of 3-5x if applied on top.

Indeed, the rapidly evolving carbon markets present a complex landscape, characterized by unique risks and significant challenges. However, the presence of insurance within these markets is paramount for their exponential growth.

The introduction of insurance mechanisms can effectively address risks, enhance confidence among investors, and consequently stimulate increased investment. This, in turn, will enable the markets to scale at the necessary rate to align with global emission reduction targets and effectively combat climate change.