India is confronting a substantial “funding gap” of over $10 trillion to meet its commitment to achieving net zero emissions by 2070, according to Finance Minister Nirmala Sitharaman.

The minister stressed the importance of establishing a carbon credit market at Gujarat’s GIFT City’s International Financial Services Centre (IFSC). The goal is to address the financial challenges associated with transitioning to green technologies.

Gujarat International Finance Tec-City (GIFT City) is a central business district currently under construction in the Gandhinagar district of Gujarat, India. Positioned as the country’s first operational greenfield smart city and international financial services center, GIFT City is a significant greenfield project.

Sitharaman further emphasized GIFT City’s role as a gateway for India’s development, projecting a GDP exceeding $30 trillion by 2047. The IFSC, she stated, should evolve into a diverse fintech laboratory to support the country’s economic advancement.

The Gateway to India’s Net Zero Goal

Current regulations prevent Indian companies from directly listing overseas. Instead, they can access foreign equity markets through depository receipts like American Depository Receipts (ADRs) and Global Depository Receipts (GDRs) only after completing an initial public offering (IPO) in India.

Sitharaman announced that Indian companies would be able to access global capital by directly listing on exchanges at the IFSC. This will provide them a platform for raising funds for green initiatives.

Prime Minister Narendra Modi suggested creating a platform for trading green credits, facilitating the sale of carbon credits. These credits are usually from initiatives such as tree planting.

The PM specifically said that:

“According to certain estimates, India will need at least $10 trillion to achieve its net zero targets by 2070. This will need to be financed through global sources. Therefore, we must make IFSC a global hub for sustainable finance.”

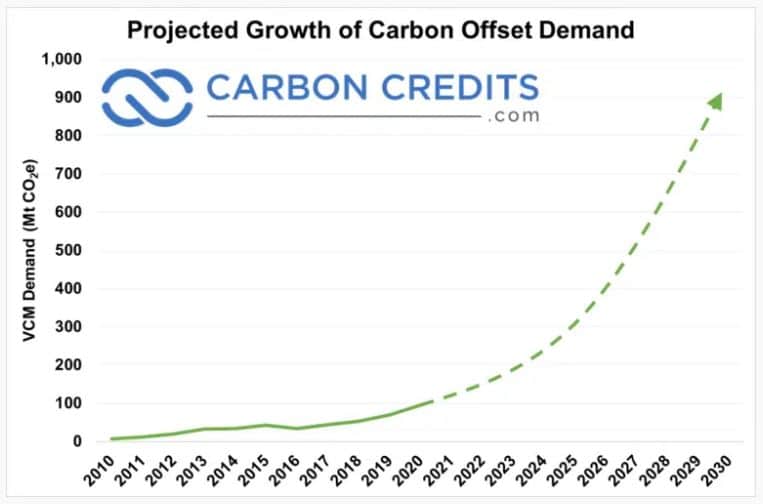

Carbon markets play a crucial role in enabling businesses to trade carbon credits, aiding in achieving their emissions reduction targets. These markets allow carbon credits to be sold and bought by businesses and other entities. Voluntary carbon markets trade carbon credit offsets, which demand poised to grow rapidly.

Carbon credits are the underlying commodities that enable the buyer to retire a certain amount of greenhouse gas emissions and help them meet their targeted emissions cut. One carbon credit represents one tonne of carbon removal or reduction.

These carbon credit markets are gaining traction, as an increasing number of global firms are committing to net zero targets. These entities also play a pivotal role in curbing India’s emissions.

The super-emitter revealed its long-term strategy to achieve net zero by 2070 at COP27.

The Rise of Carbon Trading in India

The world’s third largest emitter has made ambitious NDC commitments. Some of them are definitive and measurable while some emission reduction plans still lack quantifiable aspects.

India’s updated NDC include two major climate goals:

- Reduce emissions intensity of its GDP by 45% from 2005 levels by 2030, and

- Achieve 50% cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

The Paris Agreement recognizes the principle of common but differentiated responsibilities, considering nations’ capabilities and bandwidth for emissions reduction.

To address this, key data should be made public, including the GDP projection for 2030, growth drivers under different energy scenarios, and the methodology used. This information will allow the calculation of carbon intensity of GDP under various energy mix scenarios.

To bridge the gap between estimated emission intensity and NDC commitment numbers, sector-specific GHG emission targets can be established. Sectors such as steel, aluminum, cement, and thermal power, known for higher emissions, could have quantifiable targets based on global best practices, adapted to domestic capabilities.

The projected reduction in emissions, assuming these targets are met, should then be considered when estimating the total emission intensity reduction by 2030.

Earlier this month, Gujarat and its forest department, has signed various Memorandums of Understanding (MoUs) worth over $266 million of carbon credits from planting mangroves. Agreements have also been inked for carbon credits through agroforestry.

Unlocking Global Capital Via Carbon Credits

The Indian Government has taken a positive step by notifying the Carbon Credit Trading Scheme (CCTS) under the Energy Conservation Act, 2001. The CCTS outlines GHG emission intensity reduction targets for entities in specific sectors. It aims to establish a regulated domestic carbon credit trading market with transparent price discovery.

The Bureau of Energy Efficiency (BEE) is responsible for administering the scheme and setting targets for obligated entities, while the Central Electricity Regulatory Commission (CERC) regulates carbon credit trading.

Now, Indian businesses find themselves on the verge of a lucrative venture by entering the thriving global carbon trading markets.

As India grapples with its funding gap for net zero ambitions, the emergence of GIFT City and innovative financial strategies offer a glimmer of hope. From carbon credit agreements to direct listings, the nation is poised for a transformative journey towards a sustainable future.