Carbon financing for clean cooking: A pathway to sustainable development

Climate Change and Greenhouse Gas Emissions

Climate change refers to long-term shifts in temperatures and weather patterns. Anthropogenic or human activities have been the main driver of climate change, primarily burning fossil fuels like coal, oil and gas and clearing land and cutting down forests. Cutting down trees and using the firewood for cooking releases carbon dioxide in the atmosphere. Production and transport of coal, natural gas, and oil and also livestock and other agricultural practices, land use, and the decay of organic waste in municipal solid waste landfills releases methane. Carbon dioxide and methane are the primary greenhouse gases (GHG) that trap heat in the earth’s atmosphere- thus resulting in temperature and associated changes in weather patterns.

Emission Reductions and Removal

Emissions reductions refer to activities that reduce GHG emissions from their business-as-usual practice. For example – if a household using biomass fuel such as firewood and charcoal decides to switch over to electricity for part or all their cooking – then such actions result in emissions reductions – especially when electricity is produced using renewable energy sources such as hydro or wind. Removal of emission is, on the other hand, carrying out activities that take out or capture emissions already released in the atmosphere, such as reforestation or using technologies such as carbon capture and storage.

Carbon Credits, Offsets, and Markets

When emission reductions or removals are verified and/or certified using scientific procedures and methodologies, then they may be eligible to receive carbon credits. Countries, companies, or individuals can use carbon credits to compensate for their GHG emissions by purchasing carbon credits from entities that remove or reduce GHG emissions. Carbon market refers to trading systems in which these carbon credits are generated and traded. When an entity uses a credit it becomes an offset and is no longer tradeable. Carbon markets help drive innovations for efficient production and use of carbon credits.

Compliance Carbon Market

Carbon markets organised as part of regulatory and legislative requirements are called compliance markets. The EU Emissions Trading System (EU ETS), set up in 2005, is the world’s first major compliance market and the biggest carbon market. Under the Kyoto Protocol, three mechanisms (Emissions Trading, Joint Implementation and Clean Development Mechanism) were set up from 2008 that allowed industrialised countries to trade and purchase credits to meet their emission reduction commitments. The Paris Agreement, the follow-up to the Kyoto Protocol, which was adopted in 2015 and implemented from 2021 is expected to be the world’s largest compliance market where nations can trade credits to meet their emission reduction targets as part of their Nationally Determined Contributions (NDCs). NDCs embody actions that each country will take to reduce national GHG emissions – updated every five years.

Voluntary Carbon Market

Voluntary carbon markets (VCM) function outside of compliance markets and enable companies and individuals to purchase carbon credits on a voluntary basis to contribute towards reducing climate change impacts. The Integrity Council for Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Market Integrity Initiative (VCMI) are the major initiatives governing the VCM. The ICVCM aims to set and maintain a voluntary global threshold standard for quality based on the Core Carbon Principles (CCPs) and its Assessment Framework. The VCMI’s Claims Code addresses the demand side ‘Integrity’ by guiding companies on how they can credibly make voluntary use of carbon credits and how they can make claims regarding the use of those credits.

Carbon Finance

Carbon finance or financing is the strategic use of revenues from the trade of credits. The use of carbon finance for clean cooking, alongside other household services (e.g., water filters), have typically reduced upfront costs thus incentivizing investments from individual households. Most carbon finance transactions already include some indication regarding the wider benefits arising from the activity (e.g., gender and health benefits). There is widely considered to be potential to expand and deepen the evaluation of the SDG benefits through clean cooking carbon finance activities, driven by growing social and environmental impact markets. Carbon financing is an innovative financial mechanism aimed at reducing greenhouse gas (GHG) emissions by investing in projects that generate carbon credits. One of the significant applications of carbon financing is in the promotion of clean cooking solutions. Traditional cooking methods, which primarily rely on biomass like wood, charcoal, and dung, are major sources of indoor air pollution and deforestation. Clean cooking technologies, such as improved cookstoves and clean fuels, not only mitigate these environmental impacts but also enhance public health and socio-economic conditions.

The Problem with Traditional Cooking Methods

Traditional biomass cooking methods are prevalent in many developing regions. These methods have severe consequences:

Clean Cooking Solutions

Clean cooking technologies aim to address these issues by providing more efficient and environmentally friendly alternatives. These include:

How Carbon Financing Works

Carbon financing involves the generation and sale of carbon credits, which represent a reduction of one ton of CO2 or its equivalent in other GHGs. Here’s how it works in the context of clean cooking:

Benefits of Carbon Financing for Clean Cooking

Challenges and Considerations

While carbon financing offers substantial benefits, several challenges need to be addressed:

Carbon financing for clean cooking represents a transformative approach to tackling environmental, health, and socio-economic challenges. By leveraging the financial incentives of carbon markets, it is possible to scale up the adoption of clean cooking technologies, thereby contributing to sustainable development goals. Continued efforts to address challenges and enhance the effectiveness of carbon financing mechanisms will be essential in realizing the full potential of clean cooking initiatives.

Crediting Standards and Mechanisms

Figure 1 shows some of the crediting standards and mechanisms that are available in the market. The report – Overview and Comparison of Existing Crediting Schemes provides a comparison of different standards and mechanisms. Some of these only deal with carbon credits from particular sectors such as forestry e.g., Regen Network, REDD+ and others such as Verra and Gold Standard allow carbon credits from multiple sectors.

The most significant providers of standards and methodologies for clean cooking projects are the United Nations Framework Convention on Climate Change (UNFCCC), Gold Standard (GS) and Verra.

UNFCCC: Clean Development Mechanism (CDM)

The CDM is a flexible mechanism defined in Article 12 of the UNFCCC Kyoto Protocol, which for the first time allowed industrialised countries (known as Annex 1 countries) to compensate for their emissions with credits from developing countries (known as Non-Annex I countries). The mechanism introduced a standardized instrument, the Certified Emission Reductions (CERs) credits, each equivalent to one tonne of CO2. The Protocol was adopted on 11 December 1997 but entered into force only on 16 February 2005 with implementation agreed for the first five years: 2008-2012. In Qatar, on 8 December 2012, the Doha Amendment to the Protocol was adopted for a second commitment period: 2013-2020. As of March 2022 (article), CDM has issued nearly 3 billion tonnes of CO2, with around 8,000 projects registered – and clean cooking contributes a substantial portion of this issuance.

UNFCCC: Article 6.4 Mechanism

The Paris Agreement in 2015 effectively replaced the Kyoto Protocol and the CDM infrastructure is now being adapted and amended for implementation of the Paris Agreement’s Article 6.4. The standards and procedures for the transition of CDM projects to Article 6.4 mechanism, will be effective from 1 Jan 2024. It is then expected that projects under temporary measures in this transition period would start to generate the Article 6.4 units, each equivalent to a tonne of CO2. Projects under transition measures are those that requested registration, or renewal of crediting periods, on or after 1 January 2021. Countries can then trade, or use issued Article 6.4 credits to meet their NDCs. The Article 6.4 mechanism related rules, modalities, procedures, and guidelines will be evolving with further implementation of the Paris Agreement.

Verra: Verified Carbon Standard (VCS)

The VCS Program is Verra’s signature crediting mechanism which is the world’s most widely used GHG crediting program. Verra is registered as a not-for profit organization founded in 2007, which serves as a secretariat to various standards. It issues Verified Carbon Units (VCUs) each equivalent to one tonne of CO2. In terms of volume, it is the largest voluntary standard in the world as of September 2023, having certified reductions of more than 1.1 billion tCO2 from more than 2,000 projects in 88 countries since 2006 – in a wide range of sectors. The VCS Program is also endorsed by the International Carbon Reduction and Offset Alliance (ICROA) and meets the ICROA Code of Best Practice.

Gold Standard (GS)

The GS is a foundation established in 2003 by WWF and other international NGOs to ensure projects that reduce carbon emissions featured the highest levels of environmental integrity and contributed to SDGs. It has evolved its work around the Paris Agreement and the SDGs, and launched the Gold Standard for Global Goals (GS4GG) in 2017, which seeks to leverage climate actions for greater impacts. It issues Verified Emission Reductions (VERs), each equivalent to one tonne of CO2. As of September 2023, nearly 3,000 projects from 100 different countries have been registered generating 266 million tCO2 with a shared value of US $41 billion. SustainCERT is the official certification body for GS4GG which manages certification for GS’s carbon offset project portfolio.

Cooking credits in the VCM are largely issued by VCS and GS. Clean cooking projects represent nearly 20% (841 projects) of all the projects registered with the voluntary carbon standards with more than 90 million credits issued – as of Jan 2023. Just under one-third (27%) or 224 of these projects distribute cooking fuels or stoves that meet the 2014 World Health Organisation (WHO) definition of clean attributes, that is, they meet Tier 4 or higher rating across the six measurement attributes of the Multi-Tier Framework. This means that the majority of VCM cooking project activities replace traditional biomass stoves (i.e., three stone fires or inefficient biomass stoves) with improved biomass stoves – indicating Tier 3 transitional or, in the worst cases, even Tiers 1-2 polluting stoves – with marginal benefits. Most of these projects using Tier 4 and above solutions (218) are registered with the GS and only five projects are registered with the VCS. The credits generated by these projects amount to 25 million – around 28% of the total registered cooking projects.

Clean Cooking Carbon Project Development

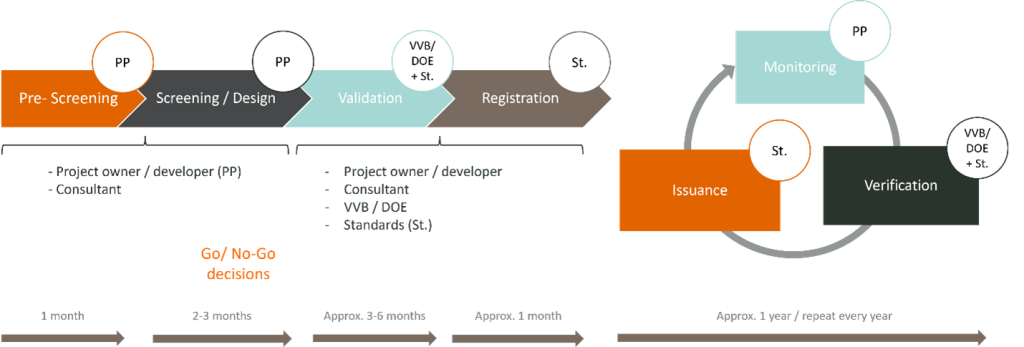

Figure 2 provides an outline of the project cycle for the development, registration, and issuance of credits from a carbon project. The average duration for the project design, validation and registration is around one year and that of the verification and issuance of credits is around a further year. (Links to Project Cycle Process – GS, VCS, CDM).

Pre-screening and Feasibility

Most projects start their implementation with a Project Idea Note (PIN). It is initiated by the project developer, in many cases with the support of a consultant. The PIN is not binding but is often used as a project pitch with the potential buyers and investors and consists of indicative information on 1) Project type, size, and location; 2) Anticipated total amount of emission reduction; 3) Crediting period; 4) Expected price per tCO2; 5) Financial structuring; 6) Project’s other socioeconomic or environmental benefits.

Project Design Document, Validation and Registration

A Project Design Document (PDD) is prepared once the initial PIN indicates feasibility of a project. The PDD is prepared following specialised formats as per the standards selected (PDD templates CDM, GS, VCS). The PDD contains the detailed argument for the ‘additionality’ of the project calculation of the project period and baseline emissions as per the specified methodology (using guidelines and design tools accompanying the methodology), justifications for the assumptions and parameter values used in the calculations, and specification of the monitoring protocols that will be followed to verify and report the emission reductions.

The PDD is developed together with the stakeholder consultation as per the standard’s guidelines. It is conducted at the field level directly with local stakeholders as well as with the national level stakeholders, to inform and discuss the process, outcomes, costs, and benefits of the project. The processes involved, the questions and concerns raised, and the redress mechanism are compiled in the form of a Stakeholder Consultation Report (Templates GS – with CDM and VCS, it is part of the PDD) and submitted along with the PDD. For CDM, the project developers also need to submit a letter of authorisation from the respective Designated National Authority (DNA). A DNA is the organization granted responsibility to authorise and approve participation in the CDM as per the UNFCCC process which are usually the respective Ministry of Environment in the country where the project is located.

Validation involves an audit of the proposed project based on the submitted PDD, Stakeholder Consultation Report and the other required documents by third-party auditors. These auditors are known as Designated Operational Entities (DOEs) under the CDM mechanism and Validation and Verification Bodies (VVBs) in the VCM. A successful validation of the project results in its registration which then leads to publication of the PDD, Stakeholder Consultation Report and the other related documents in the respective registries.

Monitoring, Verification, and Issuance

Once the project is registered, periodic verification for the issuance of credits for the project is carried out at least every two years. Projects can choose to do this every year depending on the project progress i.e., the number of project technologies installed and thus the potential credits generated which is weighed against the monitoring cost, contractual agreements, and requirements of the respective standards. After the completion of the specific milestones (annual progress), the project developer is required to conduct a project monitoring following the specific procedures predefined in the PDD. The monitoring report is then submitted to the standard/mechanism with a request for verification.

Verification involves an audit of the project based on the submitted monitoring report. A successful verification results in the issuance of credits to the project registry maintained with the respective standard/mechanism. The project developer can then use (transfer or retire) the issued credits.

Validation and verification are carried out by accredited independent auditors (List for VCS, GS and CDM). These auditors are often listed with multiple standards and mechanisms. It is also possible to carry out the validation and verification together, to reduce costs and time required, depending on the timeline of the project start date and the date of validation and verification request. Projects are credited for a period of 5 years after which the project has to go through validation with a revised PDD to check that assumptions and parameters are still relevant.

Program of Activities

A Program of Activity or PoA is developed in a similar way as an individual project but once a PoA framework is registered, an unlimited number of smaller project activities can be added without undergoing the detailed project registration process mentioned above. PoAs are therefore more suitable for activities implemented regularly and over time. Compared to independent projects, PoAs have multiple benefits, particularly for less developed countries. They lower project costs as these can be managed by a single coordinating entity and monitoring can be carried out based on a collective sampling approach. PoAs improve access to carbon revenues for smaller projects which otherwise would not be viable as stand-alone projects. This handbook prepared by Climate Focus provides details on the application of PoAs in the CDM and the voluntary carbon standards.

Methodologies, Tools, and Tests

The early CDM methodologies targeted both fuel switch to renewable energy (AMS I.E) and energy efficiency improvement (AMS II.G) and developed associated tools such as for showing additionality and specifying default parameters. Their implementation has been instrumental in building the sector including through their adaptation into methodologies developed by the voluntary standards agencies. This has seen a wider application of innovative methodologies that can cater to large-scale and broader sectoral frameworks (RECH: TPDDTEC) and for micro-scale projects covering generation of even less than 10,000 credits per year.

The VCS methodology VMR0006 is adapted from the CDM AMS II.G and was revised to version 1.2 on 6 July 2023; this incorporates both fuel switch and efficiency improvement. VCS is also developing a modular methodology called Improved Thermal Energy Generation Units, which covers a broad set of activities and consolidates elements of existing methodologies: VMR0006, AMS II.G, and AMS I.E. Similarly, GS together with CCA as part of the Clean Cooking & Climate Consortium (4C) is developing a modular methodology for crediting emissions reductions from cooking projects. CDM methodologies can be applied to the GS and VCS standards, however, the reverse is not applicable.

GS has a suite of methodologies, including the long-standing TPDDTEC updated in October 2021. GS has also now introduced a new methodology called the Metered and Measured Energy Cooking Devices (MMECD), which is specifically designed for higher-tier and modern energy cooking services: specifically electric cooking stoves including pressure cookers, as well as LPG, biogas, and bio-ethanol stoves. The particular feature of the MMECD is that it applies to projects that can measure cooking energy use in real-time or periodically e.g., with electric stoves with in-built metering. This follows the ongoing evolution of digital carbon and impact platforms, reducing project costs and also improving accuracy of emission reduction measurement- hence improving the integrity of the credits.

This Summary of Carbon Financing methodologies for Clean Cooking provides a comparison of different methodologies including links to the detailed methodologies and required tools such as for proving additionality. The synthesised information relates to scope, applicability, additionality, baseline and project fuel consumption, quantifications of baseline, project and leakage emissions, and principal monitoring requirements. There are six frequently used methodologies, and only the recent MMECD is specifically designed for the higher tier cooking services.

Information on the tests proposed and required by the methodologies for project validation and verification can be found here.

Demonstrating Sustainable Development Goal Impacts

Under the CDM, the responsibility to assess the SDG impacts lay with the DNA – which will continue under Article 6.4 mechanism. The “Article 6.4 mechanism sustainable development tool” will be developed which requires projects to provide a summary of the analysis and a monitoring plan of SDG impacts and planned remedial measures of negative impacts. This is expected to be an adapted version of the CDM SD tool used to create a thorough SDG co-benefits report. The SDG Tool offers project developers an opportunity to provide vital co-benefit information to its stakeholders.

Under GS, its SDG Impact Tool (Excel based) lays out the Monitoring Indicators to help project developers identify the SDG benefits of their projects. The use of the tool is mandatory for all new projects submitted after March 14, 2022. GS requires projects to demonstrate a clear contribution to at least three SDGs, one of which must be SDG 13. Projects can either include SDG impacts as general estimates of co-benefits together with carbon credits or use dedicated methodologies to calculate those benefits – which could be marketed separately.

Table 1 shows the most common SDG claims and indicators based on an analysis of the GS portfolio of clean cooking projects. More details can be found in More Than Just a Carbon Project report. Most benefits are measured at the activity level and simple cross-sectional surveys are the preferred method for monitoring these benefits, as questions about co-benefits can be easily added to the surveys that are required to estimate the emission reductions. It is often difficult and resource intensive to establish a causal chain from an activity to an impact, even where there are well developed methodologies. In other cases, it is difficult to quantify benefits because clear methodologies are not readily available. Consequently, to date project developers have tended to use simple if often imprecise indicators.

| SDG | Most Common Claim | Most Common Indicators | Most Common Means of Measurement |

|---|---|---|---|

| SDG1: No poverty | Reduced fuel expenses | Percentage of households confirming savings | Survey |

| SDG2: Zero hunger | Increased agricultural output | Percentage of households reporting bio slurry application to fields | Survey |

| SDG3: Good health and well-being | Indoor air quality | Percentage of households confirming reduced smoke while cooking | Survey |

| SDG4: Quality education | Training provided | Number of trainings delivered | Survey |

| SDG5: Gender equality | Time saved | Number of hours saved | Survey |

| SDG7: Affordability and clean energy | Access to affordable and clean energy services | Percentage of households reporting stove use | Survey |

| SDG8: Decent work and economic growth | Employment opportunities | Number of employees hired | Employee records |

| SDG12: Responsible consumption and production | Reduced biomass consumption | Reported tonnes biomass saved per year | Survey |

| SDG15: Life on land | Reduced deforestation | Reported tonnes firewood saved per year | Survey |

Project developers can also use GS developed impact quantification methodologies available for Black Carbon (BC) reduction and health improvement. The BC methodology quantifies the reduction in BC and the health methodology quantifies the Averted Disability Adjusted Life Years (aDALYs). aDALYs are a commonly used metric for public health reporting which represent the number of years of healthy life made possible by a clean cooking intervention. A summary of these GS Co-benefit Methodologiesis provided here.

GS has also developed a “Gender Equality Requirements and Guidelines” which carries out two levels of certification. Under this, “Gender Sensitive” certification is mandatory for all projects and “Gender Responsive” certification is optional and applicable to the activities implementing a pro-active gender responsive approach aligned with SDG 5.

International Finance Corporation’s latest brief “Clean Impact Bond: Mobilizing Finance for Clean Cooking” showcases the application of GS co-benefit methodologies and guidelines for health and gender as part of piloting a Clean Impact Bond (CIB) for a domestic biogas project in Kenya. As part of CIB, IFC provided a senior loan to BIX Capital which then on-lent it as working capital (US $300,000) to Sistema.bio to install domestic biogas plants which is to be paid back at market rates over 3 to 5 years. The Osprey Foundation purchases the health and gender co-benefits (Total maximized at $500,000) at $1,816/aDALY of health benefits and at $1/added Quality Hour of gender benefits. Cardano Development manages the credit transfers to Osprey Foundation and payments to both BIX Capital and Sistema.bio. Table 2 shows the impacts and their values that the households could generate which are significantly higher than the carbon revenues as per the current market prices.

| SDG Type | Metrics | SDG Contribution | Impact Value |

|---|---|---|---|

| SDG 3: Good health and well-being | Averted disability adjusted life years (aDALYs) | 0.0578 aDALYs (21.2 days of healthy life) per household per year | US $105 per household per year |

| SDG 7: Gender equality | “Quality Time” – Increase in women’s time used for productive tasks and/or rest/leisure | 285 hours of quality time (about 12 days) per household per year | US $285 per household per year |

Project developers can also consider using the W+ Standard, which is a framework to quantify the social capital created by women in six domains: Time, Income & Assets, Health, Leadership, Education & Knowledge, and Food Security. An example of this for a biogas project in Nepal is available here.

Verra has also developed its Sustainable Development Verified Impact Standard (SD VISta) program which is a flexible framework for assessing and reporting on the SD benefits. Methodology for Time Savings from Improved Cookstoves (ICS) is presently under development and going through assessment.

Transaction Partners and Structures

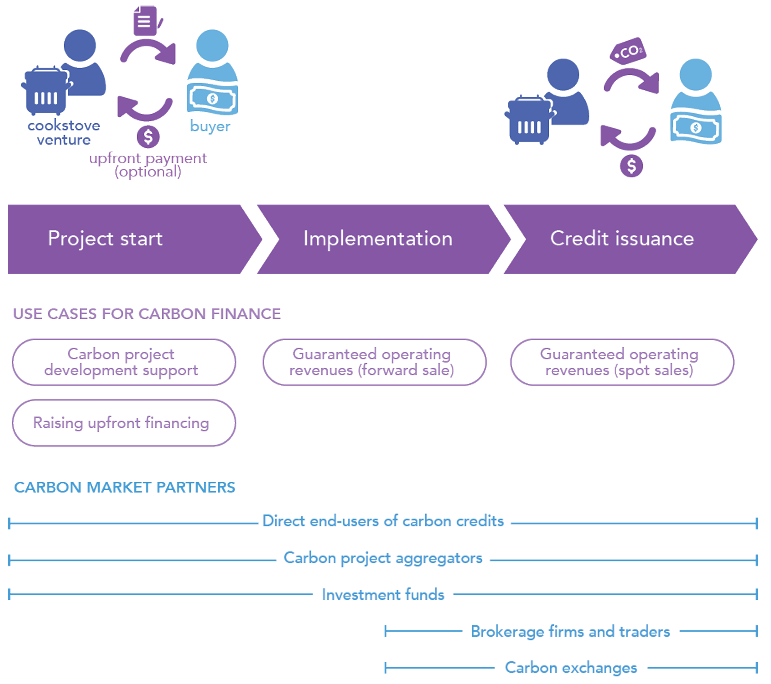

The report Making Carbon Finance work for Clean Cooking provides detailed information on how financing considerations can influence the finance partners chosen by a project developer as well as the transaction structure. How carbon revenues are to be used and the type of financing support a project developer requires can influence these arrangements. Table 3 provides an overview of transaction partners and their potential support arrangements.

| Particulars | Upfront Financing | Assistance with Carbon Project Development | Long term Offtake Agreement | Quick Transaction Support |

|---|---|---|---|---|

| Direct end-users of carbon credits | * | * | ||

| Carbon project aggregators | * | * | * | |

| Investment funds | * | * | ||

| Brokerage firms and traders | * | |||

| Carbon exchanges | * |

Project developers’ positioning in the carbon market will evolve over time as funding needs, access to finance conditions, distribution measures and the carbon market outlook change. They will also be influenced by their level of experience and consequent needs for advice and support together with their risk appetite. There are three main types of transaction structure. These structures differ in terms of their delivery conditions. Spot sales with guaranteed deliveries, and forward sales with future guaranteed and unguaranteed deliveries of carbon credits are the three types. Spot sales of available carbon credits offer the highest degree of certainty while forward sales present a mix of risk rewards to the developer and the buyer. From a developers’ perspective, the main factors influencing the decision of what contract terms to arrange may be their need for liquidity and their propensity to bear risk.

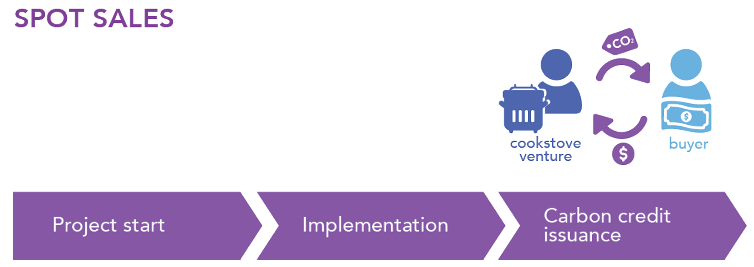

Spot Sales – Guaranteed Delivery of Credits

Once projects are registered and credits are issued, these can be sold in the market. This ability to promptly deliver carbon credits offers security to buyers, generally translating into higher pricing. Project developers may transact spot carbon credits directly to end-users. Intermediaries can also support spot sales, including brokerage firms, traders, and exchanges. While selling spot may help the negotiation power of the seller, not all project developers are able to wait several years before capturing the benefits of carbon finance. Furthermore, project developers would then shoulder the market risk associated with changes in pricing. Figure 3 shows the spot sales of carbon credits.

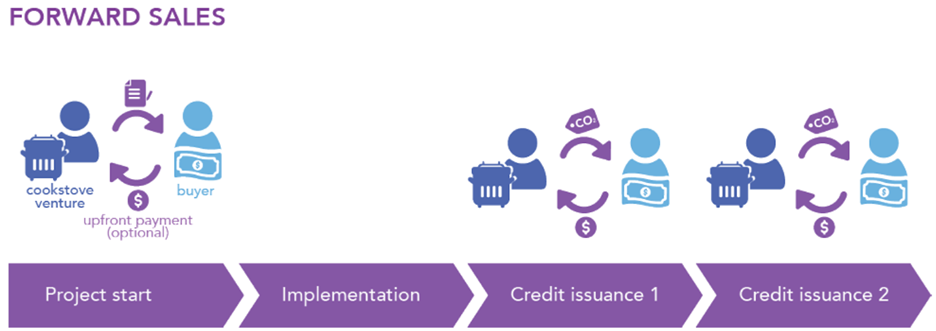

Forward Sales: Guaranteed and Non-guaranteed Delivery of Future Credits

Project developers can opt to lock-in a price for future carbon credits delivery to hedge against future uncertainties. A forward sale occurs when the project developers and buyers commit to transacting a volume of future carbon credits by a pre-defined time. Figure 4 shows the structure for forward sales of carbon credits. Where this future volume is non-guaranteed, project developers commit to deliver up to an agreed volume to the buyer, with the buyer taking on any under-delivery risk. However, this might result in a price discount on such forward sales.

Project developers can also offer a guaranteed future delivery, committing themselves to both a firm delivery schedule and delivery volume. Pricing of such guaranteed future deliveries will be higher. However, developers need to be careful, as any under deliveries will have financial implications. As such, guaranteed future deliveries are generally only offered by established project developers.

Pricing may be fixed, be indexed to inflation, or track the price development of a publicly traded standardised carbon contract on a recognised exchange. Forward contracts can be signed directly with end-users, which can be supported by aggregators, investment funds, as well as brokerage firms or even some exchanges. Parties can be willing to offer partial prepayments, allowing project developers to mobilise upfront financing to fund operations.

The ‘Use Case’ and Partner Choices

Project developers can ‘use’ carbon credits strategically to maximise revenues and to overcome barriers to market entry or scaling. This, in turn, guides the selection of partners, depending on the type of transaction which may range from one-off sales to long-term collaborations where partners bring technical or managerial expertise alongside upfront financing and premium prices. The decision of when and under which conditions to sell carbon credits will therefore be driven by project developers’ needs. Figure 5 shows the different use cases in relation to the role of different categories of carbon market partners.

Experienced carbon project developers can pursue new carbon projects independently and prioritise offering spot sales or guaranteed future deliveries. This may allow them to achieve a higher value. For project developers who are less experienced and/or with limited upfront financing, it may be better to pursue partnership with specialised intermediaries who can help with both the project development and access to upfront finance. This latter strategy is likely to translate into a significantly lower carbon revenue share especially where the carbon asset development process and carbon credit delivery risk is transferred to the partner organisation. However, developers would then gain the advantage of hedging price risk as well as the support of an experienced organisation to navigate them through a complex process.